AMZN

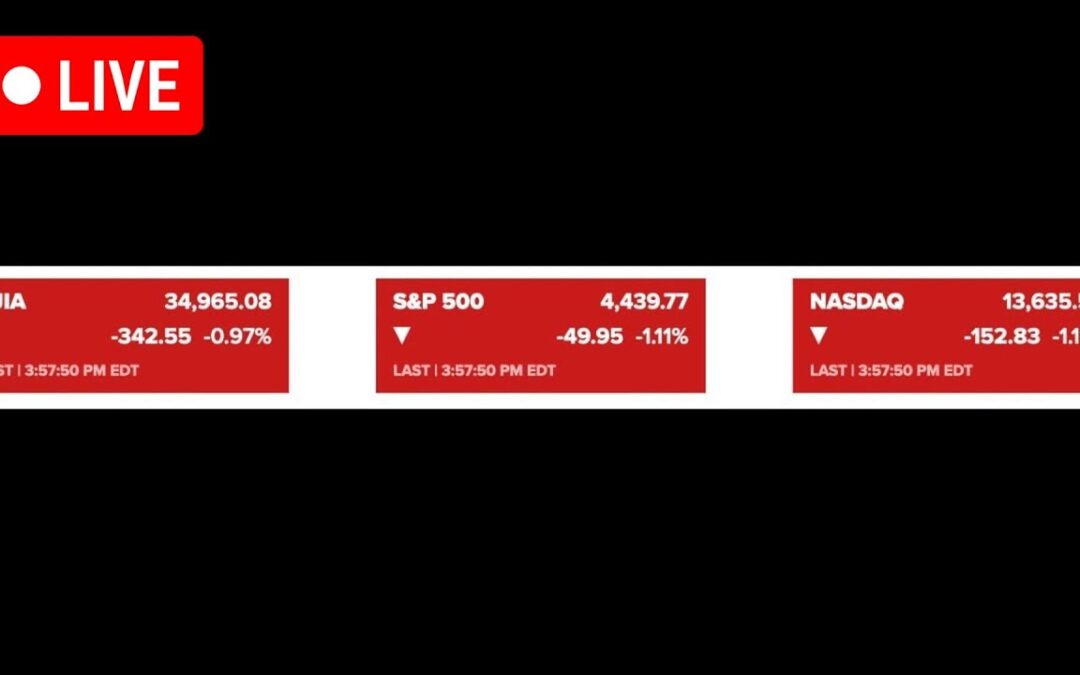

⏳ Despite market downturns, Amazon is presented as a solid long-term investment, suggesting current price levels (around $170-$200) are acceptable entry points for future returns.

📉 The primary risk highlighted is potential multiple contraction due to recession fears, which could delay recovery, but this is framed as less concerning for long-term investors.

🧘♂️ The discussion emphasizes ignoring short-term volatility and focusing on the company’s fundamental strength, suggesting panic selling is counterproductive.

@bernardodegarcia:

“Is this the end? Amazon falls, well, so what? Is this the end of Amazon? No. Okay, if you are buying Amazon at 170, fine. If you are buying it at 180, fine. If you are buying it at 200, the truth is that I think it’s fine too. Obviously, the price at which you buy will affect the return in the future, but I don’t think we are in a future where Amazon doesn’t have great returns. The risk of Amazon is that with the recession, the multiple could fall, contract the multiple, and take quite a while to recover. That is the biggest risk, that it could take quite a while to recover. And while it’s falling, what are you doing? Not buying more? That’s the biggest risk. Well, risk if you don’t want to make money tomorrow. If you want to make it the day after tomorrow, well, I don’t know what the risk is.”

Watch the exact part of the video where @bernardodegarcia talks about Amazon here:

Watch the video on YouTube

Read more articles analyzing Amazon (AMZN) at the following link. AMZN stock.