IBKR

📈 Commission Revenue showed strong growth, rising 36% to $514 million, indicating robust trading activity.

📉 Net Interest Income (NII) growth slowed to 3%, with future pressure expected as interest rates potentially decline, impacting a key revenue source.

⚖️ Valuation analysis suggests the stock is trading around 22-23 times earnings, near its historical average, but a lower multiple (around 17-18x) might be more attractive given the NII headwinds.

@bernardodegarcia:

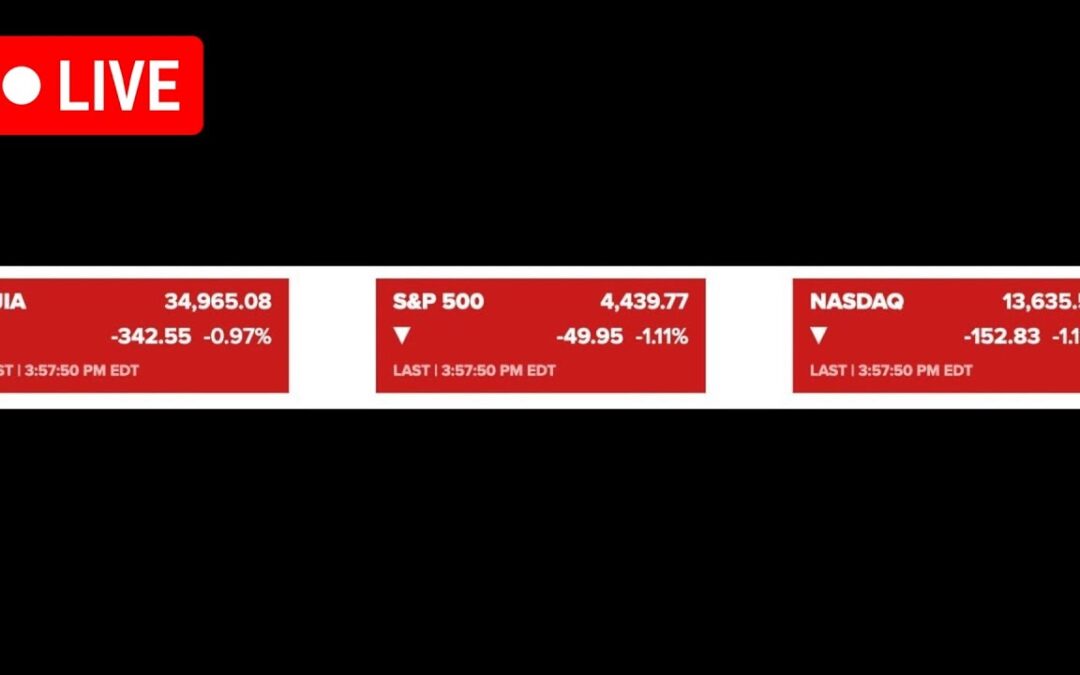

“We saw something that caught my attention in the Interactive Brokers results: Net Interest Income rose 3%, obviously Net Interest Income was rising much faster before, but Commission Revenue rose 36%. Now, notice more or less that the Net Interest Income is the core, so to speak, of Interactive Brokers, okay? But the Commission Revenue has risen significantly, 36%, $514 million, okay? For this type of company, Euronext, Interactive Broker, CBOE, I think these are financial companies with great moats. FICO, Moody’s, okay? Here are the commissions as we are seeing, $514 million. Total income, $1.7 billion. So you fell? Why are you telling me you went up? I don’t understand. Net interest income rose to $770 million. Interest income… Ah, no, okay, the total net interest income. Alright, because of course, you have the NIM. Ah, okay. Here, $770 million. Okay, so on one hand, it has $657 million, and on the other hand, it has the $770 million. Finally, it has the $1.4 billion dollars. Good revenue, but well, I suppose the market is pushing the shares down because, as I was saying, one of the risks when investing in Interactive Brokers is that, of course, throughout this entire period, just like what happened with the banks, we have seen their net interest margin increase, but that is turning around because, well, the Fed is cutting interest rates, I don’t know if we’ve noticed, and this will end up negatively affecting Interactive Brokers. It might not affect it negatively if there is more and more cash. If Interactive Brokers increasingly has more and more client cash, this could happen, but it would need to have much more cash. But well, we’ll see. In the end, earnings per share, $1.95. We analyze this, let’s round it to two for you, for me, and stop messing around, let’s put it at eight. A business like Interactive Brokers could easily be trading at 20, 21, 22. Let’s say 22, but that’s already a bit stretched, $176, and there we have it, more or less. Okay? It’s currently trading below… Here it says a forward P/E of 24. I think it’s a bit lower, but there you have it. $168. What’s the problem? Well, what is the real price target for Interactive Brokers in a few years? Especially considering that one of its main sources of income, the Net Interest Income, is heading down. Well, that’s where I would say, look, right now I’m not interested in buying at a multiple of 22; I’m interested in buying at a multiple of 18 because, well, the situation is going to get a bit complicated. Looking at the multiples we have here for Interactive Brokers, there you see them. Well, the average is 23. I think that’s a rather exaggerated average, huh? No, currently it’s at 23, sorry. The average is 22.8. Okay, 17 sounds like a good plan, undoubtedly. 17 sounds like a good plan.”

Watch the exact part of the video where @bernardodegarcia talks about Interactive Brokers here:

Watch the video on YouTube

Read more articles analyzing Interactive Brokers (IBKR) at the provided link. IBKR stock.