AMD at a Crossroads: Waiting for a Signal Amidst Market Catalysts

📉 AMD has completed its current patterns and made its expected rebound according to the technical analysis presented.

⏳ No immediate entry point is visible; a period of lateralization near a support zone is suggested as necessary for validation before considering a new position.

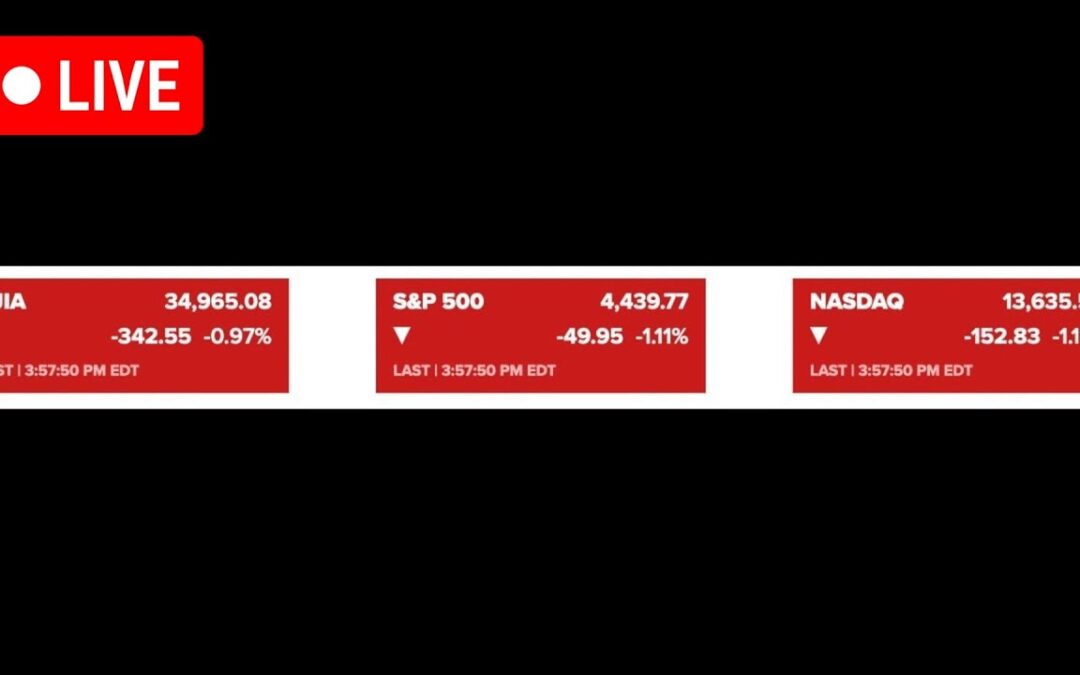

📊 The stock's near-term movement is currently seen as highly dependent on broader market news, such as Federal Reserve announcements, as it lacks a clear independent trading pattern at the moment.

AMD Faces $1.5B China Hit: Optimism vs. Reality

🇨🇳 AMD announced that U.S. restrictions on sales to China will cost the company $1.5 billion in revenue this year, primarily impacting its MI308 chips.

📈 Despite this setback, CEO Lisa Su remains optimistic about overall demand for AI infrastructure and expects new chip launches to boost sales in the second half of the year.

⚠️ The company faces investor concerns over trade restrictions, tariffs, and intense competition with Nvidia in the burgeoning AI market.

AMD’s Mixed Earnings: Data Center Growth Strong, But Is It Enough?

📈 AMD reported Q1 revenues of $4.0 billion, marking a 36% year-over-year increase, with a net income of $709 million (10% margin) and EPS of $0.44, though revenues fell 3% sequentially.

💻 The Data Center segment revenue grew an impressive 57% year-over-year, although it experienced a 5% sequential decline. Client and Gaming segments also showed annual growth but were less dynamic.

🔮 AMD guided Q2 revenues flat at around $7.4 billion, with non-GAAP gross margins estimated at 43% (or 54% excluding inventory charges), raising questions about its high valuation (98x future P/E vs. a potential 36x).

AMD. Breaking the Bearish Channel

📈 AMD has broken a bearish channel on the daily chart, suggesting a potential upward trend.

⏳ The stock has time to rise further, with a possible target at the 200-day moving average.

🔍 Investors should wait for resistance and consider potential entry points after a pullback, indicating a cautious but optimistic outlook.

AMD Soars with Gap and Breakout. Bullish Signal?

🚀 AMD's stock price experienced a significant gap and breakout, indicating strong bullish momentum.

📈 The upward movement suggests a potential search for new highs, aligning with the recovery of the 'magnificent seven'.

📊 The technical indicators, including the gap and breakout, point towards a positive outlook for AMD.