Amazon: Long-Term Hold Despite Market Pain?

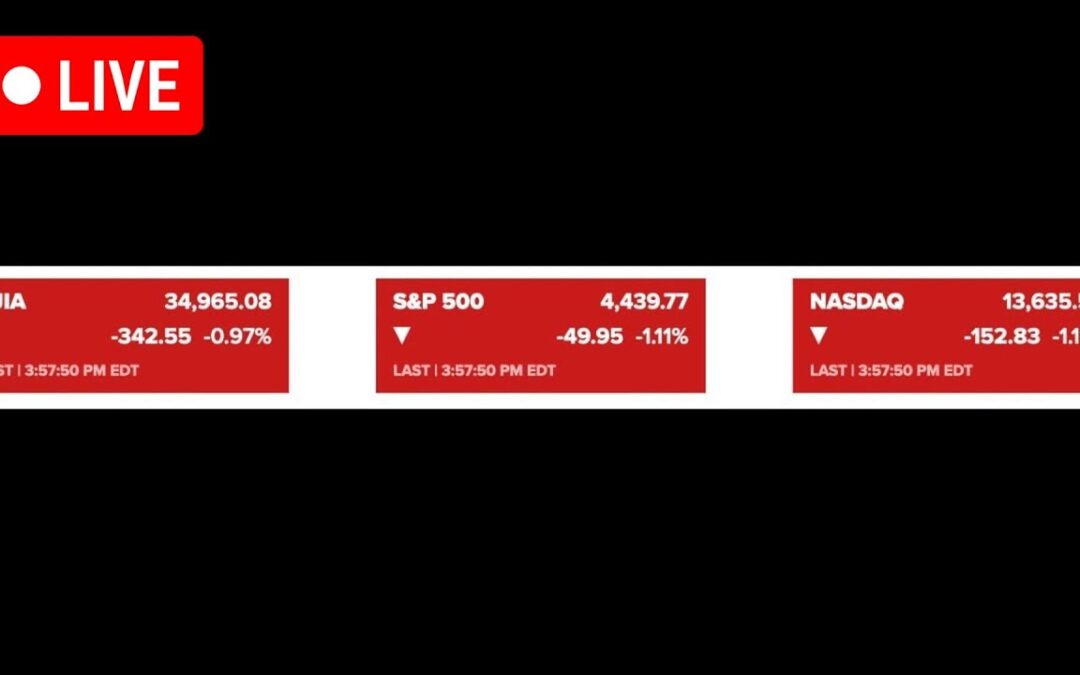

⏳ Despite market downturns, Amazon is presented as a solid long-term investment, suggesting current price levels (around $170-$200) are acceptable entry points for future returns.

📉 The primary risk highlighted is potential multiple contraction due to recession fears, which could delay recovery, but this is framed as less concerning for long-term investors.

🧘♂️ The discussion emphasizes ignoring short-term volatility and focusing on the company's fundamental strength, suggesting panic selling is counterproductive.

Amazon Hit Hard by Tariff Fears: E-commerce Giant Slumps

📉 Amazon experienced a significant 11.27% drop this week, highlighted as one of the potentially most affected large-cap stocks by the tariff situation.

🛒 The company's heavy reliance on e-commerce makes it vulnerable, as the market anticipates increased costs and reduced consumer spending due to potential widespread tariffs.

🐻 The analysis suggests that if a trade war escalates, Amazon's business model could suffer significantly due to disruptions in global trade and increased operational costs.

Amazon’s Puzzling Plunge: Opportunity Knocking?

❓ Amazon's significant 10% drop raises questions, especially when compared to Chinese e-commerce peers like Alibaba and PDD, which didn't fall as much.

🇪🇺 The fall is partly attributed to fears of European tariffs, potentially retaliation for US actions, alongside existing issues like French fees on book deliveries deemed protectionist.

📉 Despite the sharp decline, the analysis suggests the market reaction might be exaggerated and disconnected from company fundamentals, potentially presenting a buying opportunity, recalling its resilience post-dotcom crash.

Amazon’s Puzzling Plunge: Tariffs or Something Else?

❓ The significant drop in Amazon's stock price raises questions, as the direct impact of announced tariffs seems less logical compared to potential effects on competitors.

🇪🇺 Amazon faces regulatory scrutiny in Europe, specifically challenging French fees on book deliveries as protectionist measures.

📉 Despite recent market volatility, the analysis suggests the current sell-off might be exaggerated relative to the company's fundamentals, though market panic hasn't reached extreme levels yet.

Amazon Breaks Out with a Gap. Time to Buy?

🚀 Amazon's stock price broke out of its corridor with a significant gap, signaling strong upward momentum.

📈 The gap and breakout suggest a potential continuation of the upward trend, aligning with the broader market recovery.

📊 Technical analysis indicates a bullish outlook for Amazon, driven by the recent price action.

Amazon: Is It Too Risky for a 1,000 Euro Investment?

⚠️ Investing 1,000 euros in a single company like Amazon is not recommended for beginners due to the lack of diversification, which increases risk.

⚖️ It's preferable to distribute the investment across different companies or asset classes to mitigate potential losses.

💡 Although you could invest 1,000 euros in Amazon, it would be preferable to distribute the amount in different companies, or even in different classes of assets.