Nvidia Accumulation: Whales Are Buying, Is a New All-Time High Imminent?

🐋 Significant institutional investors, including Cathie Wood's ARK Invest, are reportedly accumulating NVIDIA shares at current levels, signaling confidence.

📈 The stock is consolidating within a defined range; a breakout could lead to new all-time highs, potentially forming a 'Darvas box' or 'double bottom' pattern.

💰 Despite its massive scale, NVIDIA maintains extraordinary growth forecasts (40-60%+), underpinning its long-term investment thesis.

Nvidia Shares Surge on Potential AI Chip Rule Change

📈 Nvidia's stock jumped following news that the Trump administration plans to rescind a rule restricting AI chip sales, potentially opening up markets like China.

🔄 The current 'AI diffusion rule' by the Biden administration is viewed as overly complex and hindering U.S. innovation, with a simpler replacement planned.

🌏 This policy shift could allow Nvidia to expand its AI chip sales to China and other countries, significantly boosting its market reach and revenue potential.

Nvidia Stock Jumps on Report Trump May Ease China Chip Curbs

📈 Nvidia shares rose on a Bloomberg report that the Trump administration might rescind or ease restrictions on AI chip exports to China.

🧮 The host attempts a quantitative analysis, estimating the previous $5.5 billion revenue impact from curbs could translate to a $3.50 stock price upside if reversed, based on Nvidia's margins and P/E ratio.

🚀 The potential policy reversal is seen as a significant positive catalyst, not just for the immediate fiscal year but for ongoing growth in the Chinese market.

Nvidia Holding Strong: Key Support Level Intact

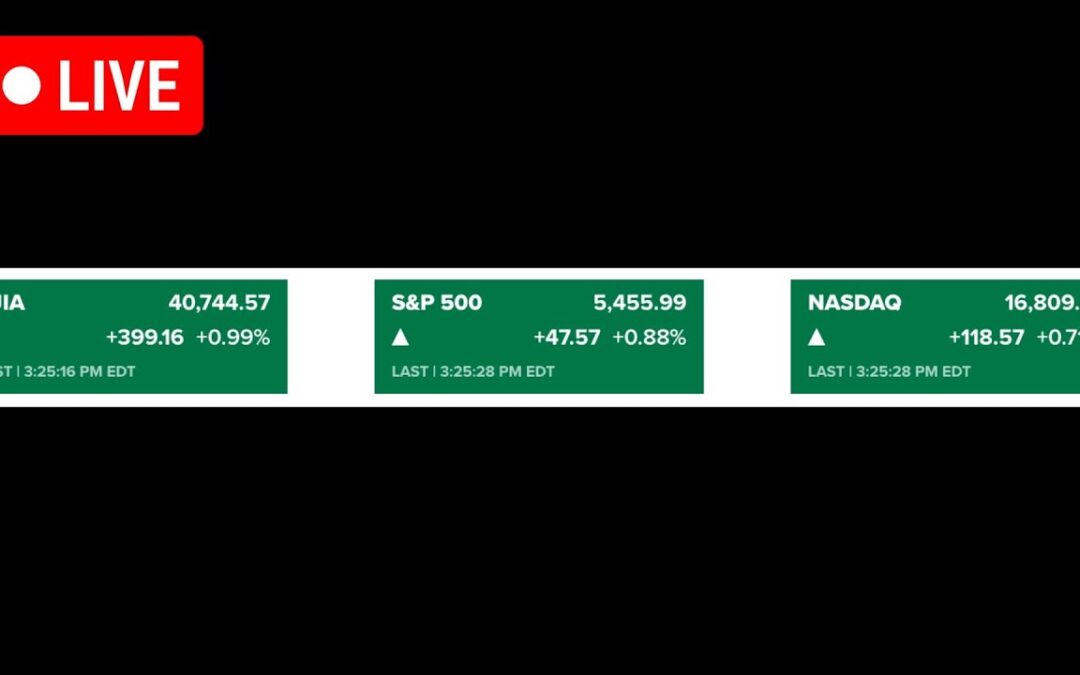

📊 Nvidia saw a modest gain of 3.14% this week but remains somewhat aligned with the broader market's performance.

⏳ The stock needs to reclaim its 40-week moving average to confirm a definitive end to the recent pullback phase.

📉 Despite recent consolidation, Nvidia continues to hold a critical support level established during its base formation, avoiding a bearish breakdown.

Nvidia’s AI Boom: Still a Buy Despite High Valuation?

📈 Nvidia is positioned as a key beneficiary of the AI and Big Data Center buildout, potentially leading the technological "cold war".

💰 Despite trading significantly below its highs, the valuation is still debated, currently around 24 times forward earnings.

🚀 While triple-digit revenue growth may not sustain, even a slowdown to 20-45% growth could justify the current valuation given its market dominance.

Nvidia Faces New AI Chip Rival From Huawei

🇨🇳 Huawei is preparing to test a new, powerful AI processor, the Ascend 910D, aimed at competing with Nvidia's offerings, particularly within China.

📉 News of Huawei's potential competitor has negatively impacted Nvidia's stock price, causing declines as the market assesses the threat.

🤔 While the Huawei chip's performance is still under evaluation and its development is in early stages, it represents a significant effort by China to build semiconductor resilience against U.S. restrictions, though Nvidia's overall growth trajectory outside China remains a factor.