Novo Nordisk Soars as Wegovy Competition Fades

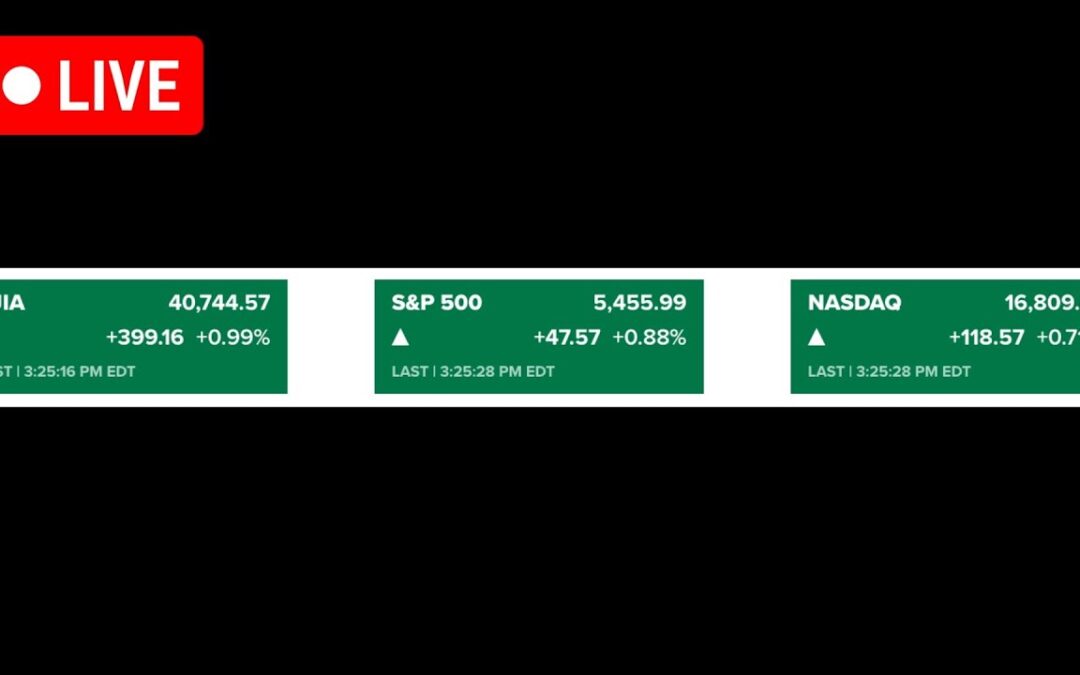

📈 Novo Nordisk shares surged nearly 6% on expectations that competition for its highly successful obesity drug, Wegovy, will diminish.

💊 The company anticipates a sales rebound in the latter half of the year as the availability of cheaper, compounded versions of its drugs is expected to end.

🎯 Despite trimmed financial forecasts, investors are optimistic, focusing on Novo Nordisk's strong position in the lucrative obesity market against rivals like Eli Lilly.

Novo Nordisk: Too Complex for Comfort?

🤷 The speaker explicitly states a lack of confidence in investing in Novo Nordisk due to being an 'ignorant' regarding the complex competitive landscape of weight-loss drugs.

💊 Mention is made of key competitors like Eli Lilly, Pfizer (which reportedly had issues with its pill), and Viking Therapeutics, highlighting the dynamic and challenging nature of the industry.

🚫 Consequently, the speaker assigns a 'zero' probability to buying Novo Nordisk shares currently, preferring industries where they feel more informed, despite acknowledging the stock's potential.

Novo Nordisk: A Potential Opportunity Amid Market Volatility

💊 Novo Nordisk's weight loss program is a key focus, with recent adjustments in pricing to enhance market penetration.

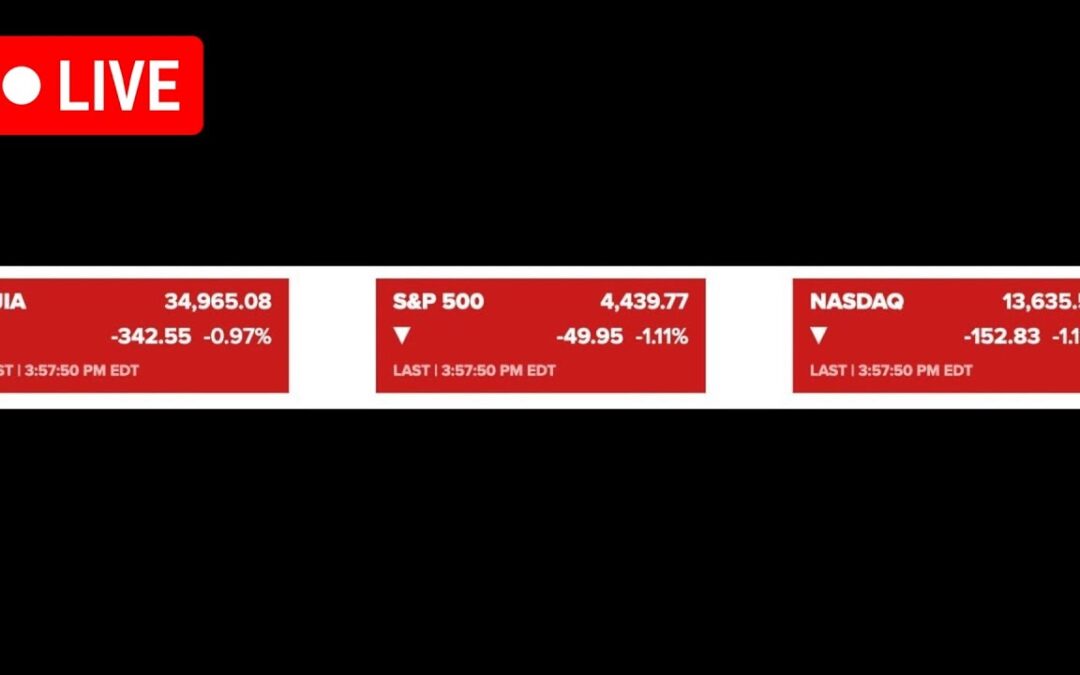

📉 The company has faced challenges in expanding its market share, but these are seen as temporary hurdles.

📈 Analysts consider Novo Nordisk undervalued, presenting a potential buying opportunity for long-term investors.

Novo Nordisk: A Promising Giant in Obesity Treatment

✅ Novo Nordisk's Wegovy has FDA and EMA approval for obesity and overweight treatment.

📈 The company has shown sustained growth in profitability, with increasing EBITDA and positive earnings per share.

💰 It maintains a stable dividend history with a payout close to 50%, offering investors consistent returns.

🔴 A sharp 20% stock drop occurred due to the underperformance of its new-generation obesity drug, Caris Erma.