Tesla’s Warning Sign: Used Car Price Plunge Signals Stock Woes

📉 The host highlights a correlation between falling used Tesla car prices on CarGurus and Tesla's stock performance.

📊 Used Tesla prices have reportedly declined over the past 30 days, presented as a leading indicator for the stock's direction.

🔮 This specific, albeit unconventional, indicator suggests a bearish outlook for Tesla's stock price based on the host's interpretation.

Tesla’s High Stakes Gamble on Robotaxis and Model 2

🚗 Tesla's valuation is considered risky, similar to Palantir's, demanding significant future growth to be justified.

📉 Recent performance has been weak, with poor quarterly results and sales not meeting expectations, increasing pressure on the company.

🤖 The company's near-term prospects heavily rely on the successful launch and adoption of the Robotaxi service and the new, cheaper Model 2 to overcome current challenges.

Tesla Sales Slump in Spain Despite EV Boom

🇪🇸 Tesla experienced a significant 16.6% drop in new vehicle registrations in Spain, contrasting sharply with the overall Spanish EV market's 54% growth.

📉 This negative data point follows disappointing quarterly results and a lack of forward guidance, suggesting ongoing challenges for the automaker.

⚠️ The combination of weak regional sales, poor earnings, and uncertain outlook indicates potential for further downside pressure on Tesla's stock price.

Tesla at a Crossroads: Sales Slump vs. Reversal Hopes

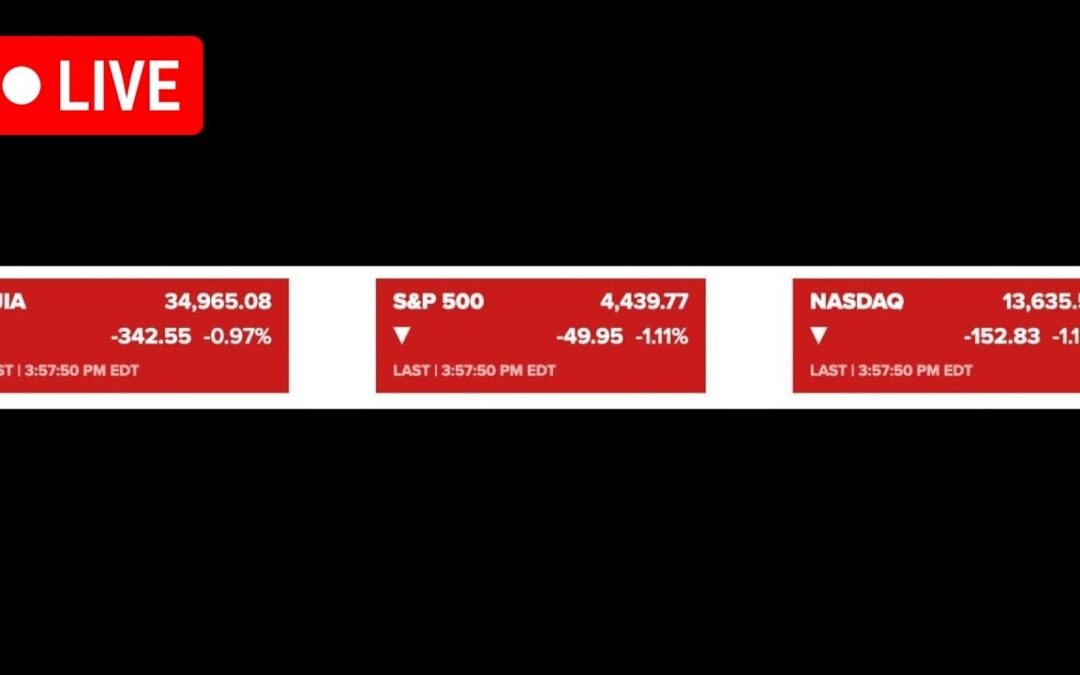

📉 Tesla faces significant headwinds: The stock price has fallen significantly after hitting highs, global sales are decelerating with Q1 deliveries down 13% year-over-year, and profits have dropped sharply.

🚗 Used car price plunge signals trouble: Prices for used Teslas have declined notably (Model Y -13%, Model 3 -10% year-over-year), presented as a key indicator suggesting potential future stock weakness.

🔄 Political impact and recovery potential: Elon Musk's association with the Trump administration appears to negatively affect brand perception among some consumers, though this damage is considered potentially reversible as focus shifts to future projects like Optimus and robotaxis.

Tesla Tumbles: Magnificent Seven Leader Takes a 40% Hit

📉 Tesla has been the hardest-hit among the 'Magnificent Seven' tech stocks this year, experiencing a significant 40% drop in its share price.

💸 Despite the sharp decline, its valuation remains extremely high, with the Price-to-Earnings (PER) ratio contracting from 198 to 118 based on trailing twelve months earnings.

📊 This performance is part of a broader trend where previously high-flying, highly valued tech stocks are facing market corrections and multiple compressions.

Tesla’s $2600 Target: Robotaxi Dream or Valuation Nightmare?

🚀 Cathie Wood projects Tesla shares reaching $2600 within 5 years, primarily driven by the upcoming robotaxi service, expected to launch commercially in June and contribute 90% of the company's value.

🤖 The robotaxi service is envisioned as a high-margin (over 80%) SaaS model, significantly more profitable than current EV sales (15-25% margins), potentially disrupting transportation by offering lower costs per mile than traditional taxis, ride-sharing, and even private car ownership in Western markets.

🤔 Critics argue ARK Invest's valuation is overly optimistic and unrealistic, valuing the yet-to-exist robotaxi business at trillions, potentially more than Apple, Microsoft, Amazon, and Alphabet combined, and vastly exceeding current valuations of competitors like Waymo or Uber.