UPS Beats Q1 But Pulls Guidance Amid Uncertainty

📦 UPS reported better-than-expected Q1 results, leading to a premarket stock increase of 1.43%.

❓ The company retracted its full-year 2025 financial forecast, citing macroeconomic uncertainty and challenges posed by Trump's tariffs impacting the package delivery market.

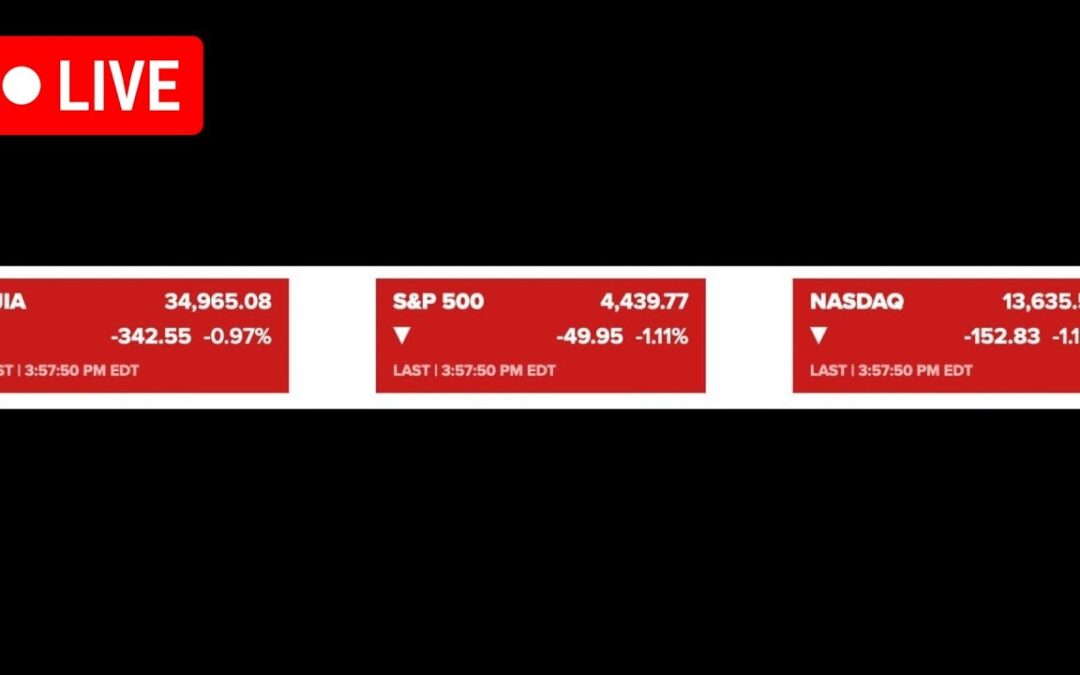

📉 This decision mirrors actions by other companies like Tesla and highlights widespread uncertainty among US businesses regarding the impact of trade policies and global economic volatility.

UPS Hits Rock Bottom Valuation, Time to Load Up?

📉 UPS is trading at a historically low valuation of 13 times earnings, significantly below its typical range, suggesting potential undervaluation.

📊 Despite recent revenue stagnation over the past two years and falling margins, the company maintains super stable free cash flow and engages in share buybacks.

🤔 While the low valuation is attractive, concerns about the lack of recent growth and industry challenges (like Amazon's logistics) warrant a cautious approach.

UPS: A Global Logistics Leader with a Stable Dividend

📦 UPS is a global leader in logistics, with a significant portion of its revenue coming from U.S. deliveries.

📊 The company's sales are stable, with steady growth, and benefits are expected to increase in the coming years.

💰 UPS offers a dividend yield of over 5% and is currently trading at a reasonable price.

⚠️ The risk associated with UPS is considered medium due to the nature of the logistics sector.